Every effort is being made on a continuous basis to institute “best practice” wherever possible to ensure that all aspects of the Group’s activities are conducted in accordance with the principles of integrity, accountability, fairness and transparency.

The King IV™ Report on Governance for South Africa defines corporate governance as the exercise of ethical and effective leadership by the governing body towards the achievement of the following governance outcomes:

- Ethical culture;

- Good performance;

- Effective control; and

- Legitimacy.

The leadership of the organisation is demonstrated in the Group Governance Framework. The effectiveness of this leadership framework is demonstrated in the narrative set out in this AIR and can be measured by the success of the Group in recent years. The Group is fully committed to the promotion of good corporate governance, which includes the application of the following:

- Code of Governance Principles set out in the King Codes;

- Our long-established governance policies and practices;

- Our Code of Ethics;

- Local and international best practice; and

- Regulatory and compliance processes of our various Boards and Committees.

These fundamentals ensure that all aspects of the Group’s activities are conducted in accordance with the principles of integrity, accountability, fairness and transparency, to safeguard the Group’s assets and protect value for all stakeholders.

GOVERNANCE, ETHICS AND COMPLIANCE STRUCTURES

The Group’s vision, purpose, culture and values form the foundation of the business and set the moral and ethical tone of the Group. Due to the expansion of the Group in recent years there has been a new drive to ensure that the entire Group, including the foreign subsidiaries, commit to the vision and purpose and also embrace and live the culture and values of the Group.

In light of this, the Group’s vision, purpose, culture and value statements were revised and updated at a recent three-day strategy meeting held in South Africa and attended by all Board members and senior management from all the Groups’ local and foreign operating subsidiaries.

Following this meeting members of the Group Executive Committee undertook a road show to all local and foreign offices to ensure that every member of staff was aware of and committed to the newly stated vision, purpose, culture and values.

The Board receives assurance on the Group’s compliance with applicable legislation, regulations, codes and standards from reports from the Chairmen of the various Board committees and compliance is a regular item on the agenda of each of these Board committee meetings.

The Board of Directors satisfies itself on an annual basis that the Group has, in all material respects, applied the principles of King III and the Code and complied with the Listings Requirements of the JSE Limited and all other applicable legislation.

APPLICATION OF KING IV

The Group utilises the Governance Assessment Instrument (“GAI”) of the Institute of Directors to assess its level of compliance with the recommendations of the King IV.

Please see the following reports in this respect:

King IV Governance Register

THE BOARD

NON-EXECUTIVE

Mark Stewart (Chairman)

Ted Garner

Ernest Ngubo

Tammy Woodroffe

EXECUTIVE

Glen Gerber (CEO)

James Robertson (GFD)

Lance van Zyl

NUMBER OF DIRECTORS

Non Executive: 4 (57%)

Executive: 3 (43%)

COMMITTEES

AUDIT AND RISK COMMITTEE

Tammy Woodroffe (Chairman)

Mark Stewart

Ted Garner

Ernest Ngubo

SOCIAL AND ETHICS COMMITTEE

Ernest Ngubo (Chairman)

Andrew Lewis

Ted Garner

Mark Stewart

NOMINATIONS COMMITTEE

Mark Stewart (Chairman)

Ted Garner

Ernest Ngubo

REMUNERATION COMMITTEE

Ted Garner (Chairman)

Mark Stewart

Ernest Ngubo

GROUP EXECUTIVE COMMITTEE

Glen Gerber (CEO)

James Robertson (GFD)

Lance van Zyl

Andrew Lewis

Gerrit Fourie

RISK MANAGEMENT

The development of the Group’s risk management strategy is a priority for the Board, to ensure risk identification and mitigation is entrenched as an on-going practice within the Santova Group so that it is an integral part of the day to day activities of operational management.

The Board’s recognition of the importance of effective risk management processes drives the mind-set of continuous reassessment and improvement of this strategy and the related processes, ensuring they remain effective and appropriate for the Group as it grows and evolves. The Board also plays a key role in the risk management process as it looks to obtain evidence throughout the year that the core objectives are satisfied, namely that:

- the most significant risks inherent in the Group’s business have been identified and are continually reassessed;

- management understands these risks; and

- management are effectively managing and mitigating these risks.

Further to the above, the Board seeks to ensure compliance with the specific risk governance recommendations of the King Code on Corporate Governance for South Africa – 2009 (“King III”) as well as other relevant codes and frameworks and best practice specific to our industries.

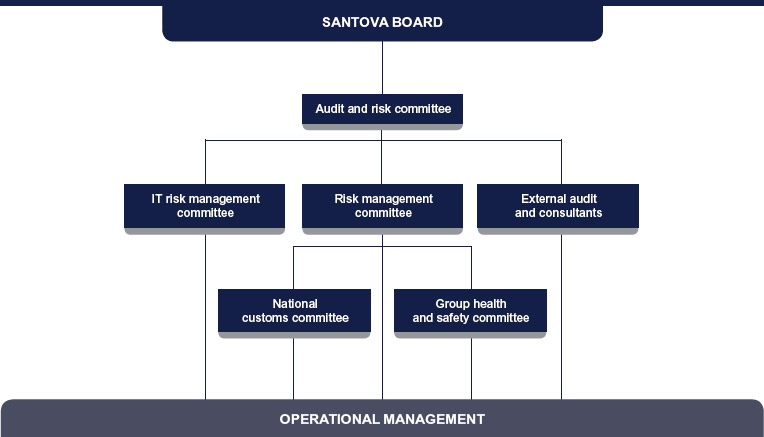

RISK MANAGEMENT STRUCTURE

The Board is ultimately accountable for the governance of risk within the Group and the following structure has been put in place to ensure that the required highly effective levels of risk management are maintained:

The Board has delegated the responsibility of ensuring that the practical risk management framework and processes are properly implemented to the Audit and Risk Committee. Membership of this committee consists of independent non-executive directors, all of whom have extensive knowledge and experience in the field of risk management.

Two primary management committees are then directly responsible for the day to day implementation of risk management processes throughout the Group and the monitoring thereof. These committees report directly to the Audit and Risk Committee on a quarterly basis.

Risk Management Committee

This committee oversees the daily risk management process for all areas of risk. All risks identified by operational management are reported to this committee on an ongoing basis through a central risk inbox set up exclusively for this purpose. The reported risks are assessed immediately to determine the level of priority and action required, and ultimately the impact and mitigation is further discussed and documented at committee meetings.

The committee is made up as follows:

Group CEO

MD Santova Financial Services

Group Financial Director

Financial Director Santova Logistics

KZN Regional Head Santova Logistics

The Group Chairman is copied on all relevant communication so that he is aware of the ongoing matters of the Risk Management Committee.

IT Risk Management Committee

This committee’s mandate is to oversee the daily IT risk management process and comprises members with the requisite IT skills and experience.

Financial Director of Santova Logistics

Group Financial Director (Chairman)

Divisional Head: Supply Chain Management

Supply Chain Management Systems Specialist – Europe

The two primary risk management committees are in turn supported by two additional risk management sub-committees as set out in the above diagram, along with a number of other informal operational forums.

In addition, the Audit and Risk Committee periodically calls upon the external auditors and certain external consultants to provide additional risk assurance.

Operating management are able to feed information involving day-to-day risk management seamlessly through this structure, ensuring an integrated approach to the practical implementation of risk management across the Santova Group.

Risk Management Process

The key aim of the Group’s risk management process is to identify, quantify and manage the key risks inherent within the Group. Identification and quantification is documented on the Risk Register and through this process management are able to assess the residual risk scores for each risk and ensure that these are maintained within acceptable tolerance levels.

At the regular meetings of the Risk Management Committee and the IT Risk Management Committee, formal agendas are drawn up and detailed minutes of the meetings are recorded. The Chairman of both the Risk Management Committee and IT Risk Management Committee attend every Audit and Risk Committee by invitation and present a formal risk report, minutes of the respective committee meetings and an update on all current key risk issues and initiatives.

The key to the Group’s risk management methodologies and procedures is the formally documented Risk Register, mentioned above, that identifies and measures all risks inherent within the Group. The Risk Register is a “live” document, under constant review and continuously updated by the Risk Management Committee, which evaluates each inherent risk identified in terms of potential impact and probability. Once an inherent risk score has been determined, responsibility for management of the particular risk is allocated and current controls and reports in mitigation of the risk are identified. This enables the control effectiveness to be determined and applied to the inherent risk to ultimately determine the residual risk score. Risks are ranked by the residual score for the purposes of directing planned future actions to be implemented by management.

The Risk Register is periodically reviewed by the Board and on an annual basis the Board performs a high level assessment of the key risks inherent in the Group, whereby each board member assesses and scores the risks. The results of these assessments, a summary of the most recent which is presented below, are combined and utilised by the Board to drive Group risk strategy and risk management.

REMUNERATION

The Group Remuneration and Nominations Committee is mandated by the Board of Directors to support and advise on the Group’s remuneration philosophy and policy, and on new appointments to the Board.

Three independent non-executive members of the Board comprise the members of the Remuneration and Nominations Committee. The Chairman of the Board does not chair the Remunerations Committee but is the Chairman of the Nominations Committee, as required by the JSE Listings Requirements, and chairs the meeting when matters requiring the attention of a nominations committee are dealt with. The Chairman of the Board ensures that Committee has access to professional advice from outside the Group where necessary.

The Group has an extremely active and efficient Group Human Resources team which looks after the issues of human resource management in terms of social transformation, moral and social responsibility. The Group has an active training programme to enhance the skills of all its employees internationally and train them in the Group’s business.

POLICY ON DIRECTORS’ REMUNERATION

The directors are appointed to the Board to bring to the Group management expertise and strategic direction and to provide the necessary skills and experience appropriate to its needs as a diversified leading global business.

In following the strategy of an international non-asset based lead logistics provider, the Group’s human capital has been identified as one of the four primary inputs into its value adding processes. Hence it is important that our reward strategies and remuneration structures are designed to attract, motivate and retain high-caliber people at all levels within the Group, whilst fostering a culture of performance.

Consideration is given to total reward and on achieving an appropriate balance between fixed and variable remuneration and short and long term incentives for all employees, depending on seniority and roles. The guaranteed remuneration component paid to directors is based on industry benchmarks and targeted just below the median of the market. The Group maintains its discretion to pay a premium to the median for the attraction and retention of the directors.

NON-EXECUTIVE DIRECTORS’ FEES

Non-executive directors do not have service contracts with the Company but instead have letters of appointment. All non-executive directors have terms of appointment of three years and one-third of the non-executive directors retire each year at the Annual General Meeting in terms of the Company’s Memorandum of Incorporation. Each retiring director who is eligible and offers himself for re-election is then subject to re-election by shareholders.

The Chairman receives an annual fee which takes into consideration his role as Chairman of the Group, his attendance at Board and Committee meetings, and the breadth of that role coupled with the associated levels of commitment and expertise.

Other non-executive directors receive fixed fees for service on the Board and Board committees on the basis of meetings attended and chairmanship of Board committees. Non-executive directors do not receive short-term incentives nor do they participate in any long-term incentive schemes. The fees paid to non-executive directors are reviewed and approved annually by Shareholder at the Groups annual General Meeting held in July of each year.

EXECUTIVE DIRECTORS’ SERVICE CONTRACTS AND REMUNERATION

Each executive director is bound by a formal contract of employment. These contracts are formulated in a manner which is consistent with industry norms and legislative requirements. The contracts are for variable terms subject to notice periods ranging between 30 to 60 days and all contracts carry post-employment restraints for a period of two years, providing protection to the Group’s client base, employees and confidential information.

The Committee aims to align the directors’ total remuneration with stakeholders’ interests by ensuring that a significant portion of their package is variable in nature. Executive directors qualify for an annual incentive bonus calculated and paid in May of each year following the finalisation of the Group’s annual results for the previous financial period. The payment of this incentive bonus is subject to the achievement of certain performance targets that are directly linked to:

- the overall Group performance for the financial year;

- the performance of the specific division for which the director is responsible; and

- the individual director’s personal performance against role specific KPIs and the extent that the director lives the Group’s cultures and values.

Executive directors’ fixed remuneration components, which are quantified on a total cost to company basis (“TCC”), are reviewed annually in March of each year by the Committee so as to ensure sustainable performance and market competitiveness. In performing this review the remuneration packages are:

- compared to current remuneration surveys and levels within other comparable South African companies; and

- reviewed in light of the individual director’s own personal performance, experience, responsibility and Group performance.

The philosophy behind these annual reviews is to award percentage increases that are typically linked to current and forecast inflation levels, so as to primarily compensate for loss of real disposable income.

The fixed remuneration component or TCC typically constitutes three elements:

- A fixed base salary;

- Contributions by the Company to defined contribution retirement plans on behalf of the executive directors on the basis of a percentage of pensionable salary and which includes death and disability cover; and

- Contributions to the Group’s medical healthcare scheme.

Executive directors do not receive directors’ fees for attending board and committee meetings and are not specifically remunerated in any way for their role as directors of the Company.

Santova Share Option Scheme

The Group operates two Share Option Schemes as a means of providing long term incentives and retaining senior management and executive directors. In terms of these Schemes the Group can grant share options to qualifying employees to acquire shares in the Company. The rules of the Schemes are set down in scheme documents that have been approved by the JSE and filed with the Companies and Intellectual Property Commission. The Company Secretary has been appointed the Compliance Officer for the Schemes and the Remuneration and Nominations Committee will govern the Schemes on an ongoing basis. Non-executive directors are not entitled to participate in the Schemes.

STAKEHOLDER ENGAGEMENT

As a non-asset based, specialised supply chain consulting business our relationships with our business stakeholders are core to our strategy and continued existence. This is emphasised by the fact that the Group’s primary business activities entail the co-ordination of and control over the forward and reverse movement of our client’s goods across the entire supply chain from source to destination. To achieve this the Group utilises the logistics resources and capabilities of specialised external logistics providers together with leading in-house developed information technology systems.

As a result, the Group’s business model is highly client centric and dependent on the establishment of long term mutually beneficial relationships with both our clients and specialised external service providers, which are facilitated by constant daily interaction between our employees and these stakeholders.

In addition, as a result of industry regulations and market practice, primarily in the South African region, the Group is required to fund recoverable logistics disbursements, principally customs duties and value added taxes, on behalf of clients. Thus the ability to raise working capital through the Group’s shareholders and bankers is fundamental to the servicing of a client, and in order to access this capital and minimise credit risk, a strong relationship with the Group’s credit underwriters is essential.

Over and above these core business and financial relationships that are fundamental to the Group’s business model, we operate in an environment that involves the flow of goods from one jurisdiction internationally to another. As a result, the Group’s interaction with Government and Regulators in these jurisdictions is vital to ensure the adherence to specific regulations and procedures and to facilitate the timeous and efficient flow of goods in and out of these regions.

PEOPLE/TRANSFORMATION

Santova’s people remain a significant part of its intellectual capital and Santova’s human capital is fast becoming one of its most important differentiators.

People

The Group Human Resources Department, based at the Santova Head Office, manages the human capital element for the Group with the assistance of all business unit leaders worldwide. The Group Human Resources Department also calls upon a network of professional specialist suppliers, where required.

Internationally, the Department handles the role of general employee management and the labour process. In South Africa, the Department manages payroll, medical aid, retirement planning, wellness, training and development as well as aspects of employment equity, broad-based black economic empowerment and sustainability. In South Africa, all employees are required to join the Group provident fund and the Group medical aid scheme (or provide proof of their own independent medical aid). Internationally, the offices have flexibility in this area to cater for local practices and laws.

The value of Santova’s human capital is evidenced in the value distributed to employees as contained in the Value Added Statement of the Annual Integrated Report.

Santova, under the leadership of the Group Human Resources Committee, promotes employee wellness throughout the Group. Whilst the international entities are encouraged to promote wellness in any way realistically possible for the size of their office complements, in South Africa this important area is driven principally through the formal employee wellness days.

Training and skills development are important to Santova as they are the core elements to growing the quality of the Group’s human capital. Enhancing the skills, capabilities and knowledge of employees is an ongoing requirement which is not only a tool to drive performance, but also contributes to employee wellness and our employment brand. In addition, it provides support to our culture, values and philosophies.

In South Africa, training and skills development are overseen by the Skills Development and Employment Equity Committee, whilst the employees who manage the day to day tasks form part of the Group Human Resources Department. Internationally, responsibility for training and skills development falls under the mandate of the business unit leaders, with support provided by the Group Human Resources Department which monitors the international progress in this area.

The training and skills development function is managed in South Africa with a formal training budget and process, whilst the international offices are given the flexibility to manage training on a more informal and ad hoc basis given the size of these regions.

Santova also operates a variety of Learnership and Graduate Programmes. Prospective candidates can apply on our Careers page on this website.

Transformation

Employment Equity

Each South African entity is responsible for managing their employment equity implementation to achieve the required targets set out in the plan.

A summary of the employment equity statistics for the South African entities can be found in the Santova Limited. Sustainability Report. It should be noted that the South African entities report separately to the Department of Labour for the purpose of employment equity, and not as a consolidated South African group as set out for summary purposes in the Annual Integrated Report.

The South African entities of the Group remain focused on addressing middle, senior and top management with junior management and clerk level already well represented. Skills shortages in our industries amongst designated group’s remains a barrier to employment equity and the Group continues to rely on its internal programmes to address employment equity. The introduction of the Santova Logistics Graduate Programme is a further initiative aimed at assisting in this area, as this programme is designed for previously disadvantaged candidates.

Broad-Based Black Economic Empowerment (“B-BBEE”)

The B-BBEE Committee, under the guidance of its B-BBEE Consultant, is responsible for the strategy, planning, monitoring and overall management of B-BBEE within the South African Group. All senior management within the South African Group are then responsible for the implementation and ongoing development of B-BBEE.

The B-BBEE report for each of the South African Group entities for the previous year can be found in the Santova Limited Sustainability Report.

The B-BBEE scores for each South African entity and associated information can be found in the abovementioned report. The report also contains detail on Santova’s contributions to Enterprise Development beneficiaries. Santova’s Enterprise Development beneficiaries are generally supported in one or more of the following methods: financial grants, computer hardware and software, motorbike, training, employee salaries, legal advice and business support.

B-BBEE suppliers, in general, continue to be an important focus for the South African entities within the Group. The spend with the historically disadvantaged black suppliers and stakeholders is contained in the Value Added Statement in Santova Limited’s Annual Integrated Report.

SOCIAL RESPONSIBILITY

Corporate Social Responsibility is a long established but continuous area of commitment for Santova.

Santova aims to deliver sustainable development which includes the economic, social and environmental needs for all its stakeholders. Santova seeks to make a positive impact, beyond the requirements of the law, which reflect both its culture, ethics and establishes Santova as a good corporate citizen.

Santova reports on social responsibility, which includes corporate social investment, in its Sustainability Report. The report covers a number of areas which contain Social Responsibly initiatives which are relevant to Santova’s stakeholders, including the following:

Employees

Human Capital, Wellness, Health and Safety, Training and Skills Development, Learnership Programmes, Graduate Programmes, Employment Equity, Broad-Based Black Economic Empowerment as well as HIV / AIDS and Other Life Threatening Diseases.

Other Stakeholders

Health and Safety, Learnership Programmes, Graduate Programmes, Employment Equity, Broad-Based Black Economic Empowerment, Enterprise Development Projects, Corporate Social Investment (Monetary and Non-Monetary) and Environment.

CHARTERS/POLICIES

- Anti-Slavery and Human Trafficking Policy and Disclosure Statement [144KB]

- Santova Group Data Privacy Policy [61KB]

- Charter of the Social and Ethics Committee [105KB]

- Charter of the Board of Directors [122KB]

- Charter of the Audit and Risk Committee [60KB]

- Charter of the Nominations Committee [49KB]

- Charter of the Remuneration Committee [55KB]

- Whistle Blower Policy [968KB]

Supplier Code of Conduct

SUSTAINABILITY REPORTS

The Santova Limited Board of Directors remains committed to sustainability and the reporting of its sustainability performance to all stakeholders in an open, honest and transparent manner.

As a non-asset based supply chain management business the Group’s employees are the key stakeholders in the implementation of its vision and strategies for long term sustainability. This is demonstrated by the fact that they are the recipients of a significant portion of the wealth created on a revenue basis by the Group, as can be seen in the Value Added statement in the latest Annual Integrated Report.

Since the 2015 financial year, the annual Sustainability Report is a separate stand-alone report and an executive summary is contained in the Santova Limited Annual Integrated Report each year. The report is now referred to as the Social and Environment Report.

Click on the relevant Report for the periods contained below:

- Santova Social and Environmental Report February 2025 [4MB]

- Santova Social and Environmental Report February 2024 [8MB]

- Santova Social and Environmental Report February 2023 [4MB]

- Santova Social and Environmental Report 2022 [4MB]

- Santova Social and Environmental Report 2021 [2.40MB]

- Santova Social and Environmental Report 2020 [2.40MB]

- Santova Social and Environment Report 2019 [4.06MB]

- Santova Social and Environment Report 2018 [4.2MB]

- Santova Social and Environment Report 2017 [3.6MB]

- Santova Sustainability Report 2016 [311KB]

- Santova Sustainability Report 2015 [227KB]