By Daily Maverick, Published May 21, 2023

Santova: the little engine that could

Our local market is notorious for being a graveyard for small- and mid-cap valuations, with companies trading at earnings multiples that are depressingly low. In a rare move, Santova’s share price chart has charted a course for the moon, up by 22% in the past month.

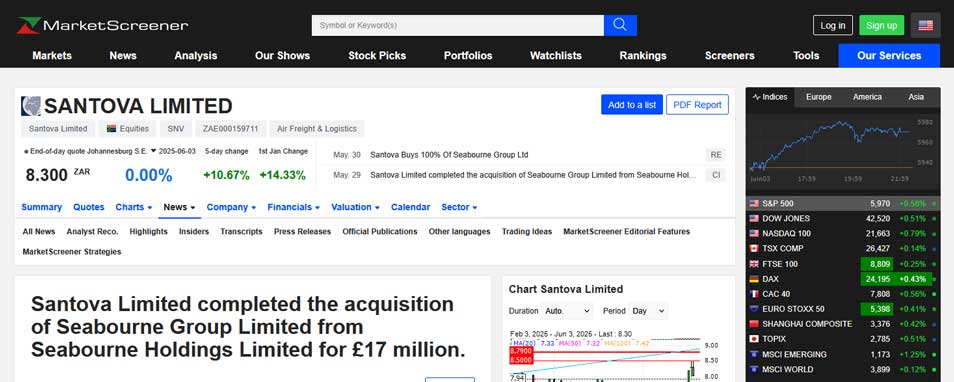

The company has been a winner at a time when supply chains were crunched and caused huge disruptions in almost every industry. Unlike Grindrod Shipping (which just reported a loss in the latest quarter), Santova is a relatively capital-light player in this industry, offering services rather than vessels or aircraft. This means a lot of working capital rather than fixed assets, which isn’t a bad thing. A return over five years of roughly 180% is evidence of that.

It’s impossible to know for sure whether the price will retract. If we could know such things with certainty, we would all be sunning ourselves on yachts rather than reading about container ships and related services.

Still, with Heps growth in the year ended February of 22.1%, Santova is doing its bit to get its investor closer to yacht status.