By Yahoo Finance, Published August 1, 2023

Simply Wall Street

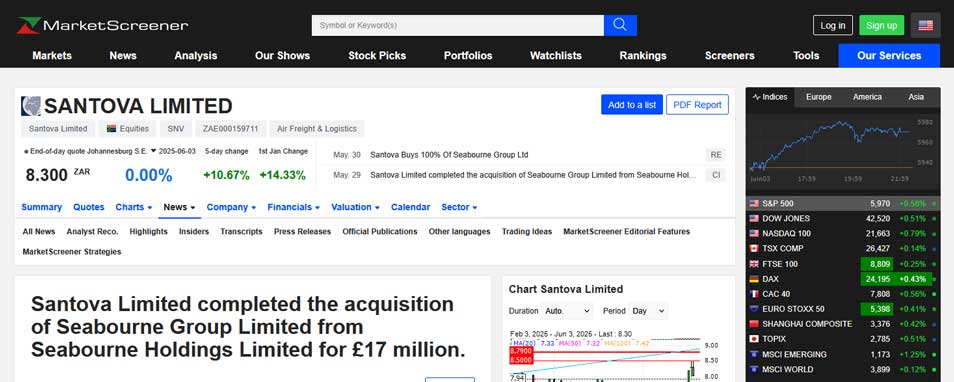

Santova Limited (JSE:SNV), is not the largest company out there, but it led the JSE gainers with a relatively large price hike in the past couple of weeks. Less-covered, small caps tend to present more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s examine Santova’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Is Santova Still Cheap?

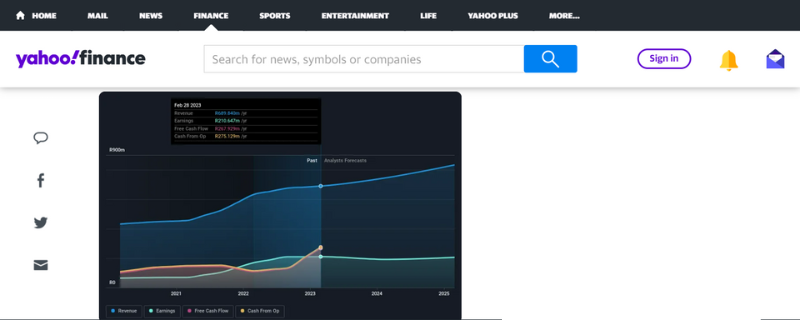

Great news for investors – Santova is still trading at a fairly cheap price according to my price multiple model, where I compare the company’s price-to-earnings ratio to the industry average. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 6.07x is currently well-below the industry average of 11.6x, meaning that it is trading at a cheaper price relative to its peers. What’s more interesting is that, Santova’s share price is quite stable, which could mean two things: firstly, it may take the share price a while to move closer to its industry peers, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.